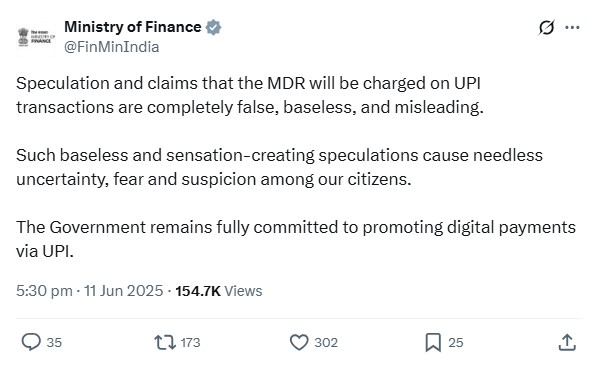

The Union Finance Ministry has officially denied media reports suggesting that the government is planning to impose a Merchant Discount Rate (MDR) on Unified Payments Interface (UPI) transactions exceeding ₹3,000. In a strong rebuttal issued via an official statement and a social media post, the ministry called such reports “false, baseless, and misleading.”

The clarification came after several media outlets claimed that the government might allow banks and payment service providers to levy MDR on high-value UPI transactions in a bid to address rising operational costs. These reports suggested a potential reintroduction of transaction-based charges that could mark a shift from the current Zero MDR policy, which has been in place since January 2020.

“Speculation and claims that the MDR will be charged on UPI transactions are completely false, baseless, and misleading. Such baseless and sensation-creating speculations cause needless uncertainty, fear, and suspicion among our citizens,” the Ministry posted on X (formerly Twitter).

The statement further emphasized the government’s unwavering commitment to promoting free digital transactions and ensuring that UPI remains a widely accessible and affordable digital payment platform for all users, including small businesses and everyday consumers.

Background: What Sparked the MDR Controversy?

The speculation originated from reports stating that the government was considering MDR on UPI transactions above ₹3,000, based on transaction value rather than merchant turnover. These claims were supported by anonymous sources and discussions reportedly taking place between stakeholders, including the National Payments Corporation of India (NPCI), banks, and fintech firms.

The Payments Council of India (PCI) had also previously recommended a 0.3% MDR on large merchants for UPI transactions. Currently, MDR charges for debit and credit cards range from 0.9% to 2%, excluding RuPay cards, which have remained exempt under the government’s financial inclusion goals.

Supporters of this proposal argue that the Zero MDR policy hampers the financial sustainability of the digital payment ecosystem. Despite growing volumes, banks and payment service providers receive little to no direct compensation for handling large numbers of UPI transactions.

A letter sent by the Payments Council earlier this year to the Prime Minister highlighted that the government’s ₹1,500 crore incentive falls far short of the estimated ₹10,000 crore annual cost required to maintain and expand the UPI network across the country.

UPI: A Pillar of India’s Digital Economy

UPI has become the cornerstone of India’s digital transaction landscape, with its ease of use, real-time settlement, and zero-fee model being key drivers of adoption. Data shows that:

-

As of June 1, 2025, UPI recorded 644 million transactions in a single day.

-

On June 2, the number further increased to 650 million, surpassing global payments leader Visa’s daily average of 639 million transactions during FY 2023–24.

For the financial year 2023–24, UPI accounted for nearly 80% of all retail digital transactions in India. The total volume exceeded 131 billion transactions, with a cumulative value crossing ₹200 lakh crore, demonstrating its central role in India’s digital financial ecosystem.

UPI’s popularity also extends beyond peer-to-peer (P2P) payments. From small local vendors to large-scale businesses, UPI has transformed how merchants accept payments without the burden of traditional banking infrastructure or credit card processing fees.

Industry Concerns and Policy Challenges

Despite UPI’s success, industry stakeholders continue to raise concerns about the economic feasibility of sustaining such a massive digital infrastructure without transaction fees. As volumes rise, so do the costs associated with server maintenance, cybersecurity, customer support, and fraud prevention.

Fintech leaders argue that the lack of incentives for banks and payment providers may eventually slow innovation and impact the quality of services. They have proposed selective reintroduction of MDR for large-ticket or commercial transactions, while keeping small-value, person-to-person payments free of cost.

However, any such policy shift must balance financial viability with the goal of digital inclusivity, which has been the cornerstone of India’s digital finance policy.

Government’s Position: UPI Will Remain Free

The Finance Ministry’s statement makes it clear that no decision has been made to introduce charges on UPI payments at this point. By directly labeling the reports as unfounded, the government seeks to maintain public confidence in the digital ecosystem.

The ministry also reaffirmed that UPI will remain a cost-free platform for end users, and that any future policy changes, if at all considered, would involve broad consultations with all stakeholders, including banks, fintech firms, merchants, and the NPCI.

Conclusion

At a time when India’s digital economy is surging ahead globally, clarity on key financial policies like MDR is essential. The Finance Ministry’s prompt clarification not only dispels public confusion but also reinforces its continued vision of an accessible, low-cost digital payment infrastructure.

As UPI continues to break global transaction records and reshape how India pays, the government’s commitment to a free, seamless, and user-first model remains a crucial factor in its ongoing success.