Income Tax Bill 2025: The Income Tax Bill 2025, also known as the Income Tax No 2 Bill, has officially cleared the Lok Sabha, paving the way for the replacement of the six-decade-old 1961 Income Tax Act. Finance Minister Nirmala Sitharaman introduced the revised draft on August 11, incorporating most of the Select Committee recommendations to make the tax framework easier, clearer, and more practical for taxpayers across India.

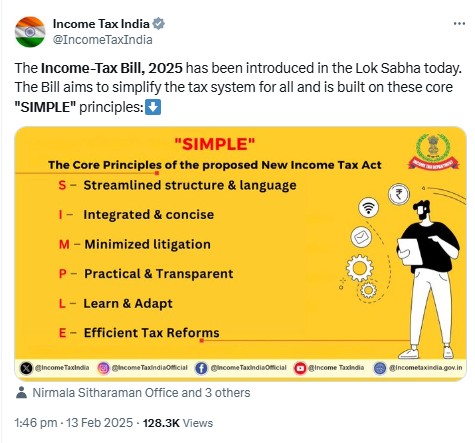

This landmark legislation, set to come into effect from April 1, 2026, follows the guiding principles of S.I.M.P.L.E — Streamlined structure and language; Integrated and concise; Minimized litigation; Practical and transparent; Learn and adapt; and Efficient tax reforms.

Why a New Tax Law Was Needed

The 1961 Income Tax Act has undergone over 4,000 amendments, accumulating more than five lakh words. Over time, this made the law overly complex and difficult for the average taxpayer to interpret. The Income Tax Bill 2025 reduces complexity by nearly 50%, offering concise definitions, simplified provisions, and clearer guidelines.

The bill also aims to reduce litigation by aligning terminology, removing redundant provisions, and introducing standardised interpretations for tax terms. This is particularly beneficial for MSMEs and individual taxpayers who often struggle with compliance burdens.

Key Highlights of the Revised Income Tax Bill 2025

-

Simpler Language and Structure

The revised draft uses accessible language so that even non-experts can understand their obligations and entitlements without relying heavily on legal interpretation. -

Clear Deductions for Commuted Pension

One of the most notable updates is the explicit deduction for commuted pension (lump-sum pension payments) for those receiving pensions from approved funds like the LIC Pension Fund. This change ensures fairness for pensioners outside traditional employment structures. -

MSME Definitions Aligned with MSME Act

The Income Tax No 2 Bill aligns the definition of micro and small enterprises with the MSME Act of 2020, ensuring tax benefits are better targeted. A micro enterprise is now defined as one with an investment below ₹1 crore and turnover under ₹5 crore, while a small enterprise has limits of ₹10 crore and ₹50 crore respectively. -

Relief on TDS and Tax Refunds

-

No penalty will be imposed for late TDS filing.

-

Taxpayers can claim refunds even after late filing of returns.

-

Introduction of Nil-TDS certificates for taxpayers with no liabilities, applicable to both residents and non-residents.

-

-

Property Income Clarifications

Clear rules are laid out for calculating income from house property, including a standard deduction of 30% and interest deductions on borrowed capital. The bill also changes how vacant rental property valuations are assessed, now using the higher of reasonable expected rent or actual rent received. -

Tax Year Concept

A major shift is the introduction of a tax year to replace the current system of financial year and assessment year. This means taxes for income earned in a year will be paid in the same year, streamlining compliance. -

Corporate Provisions

-

The provision for deductions on inter-corporate dividends has been reinstated to avoid double taxation.

-

The earlier proposal to levy Alternate Minimum Tax on LLPs has been removed, addressing industry concerns.

-

Restrictions on charitable trusts have been eased, restoring the ability to reinvest capital gains and spend in the following year.

-

-

Transfer Pricing Reforms

The definition of Associated Enterprise has been refined to remove subjective interpretations and reduce disputes in cross-border transactions.

What Remains Unchanged

Despite these reforms, the Income Tax Bill 2025 does not alter existing tax rates. The dual system of the old and new tax regimes continues, allowing taxpayers to choose the one that suits them best.

Expert Opinions on the Income Tax Bill 2025

Tax experts have welcomed the Income Tax No 2 Bill as a progressive step. Dinesh Kanabar, CEO of Dhruva Advisors, called the reforms “a set of very welcome changes,” noting that many industry concerns were addressed by the Select Committee and accepted in the final draft.

Preeti Sharma of BDO India emphasised that the law’s simpler language will make it far easier for ordinary citizens to understand their tax responsibilities.

Conclusion

The passage of the Income Tax Bill 2025 in the Lok Sabha marks a significant moment in India’s tax reform journey. By embracing the S.I.M.P.L.E principles, the law promises to modernise tax administration, reduce disputes, and make compliance less burdensome for both individuals and businesses. With its implementation from April 2026, taxpayers can look forward to a more transparent and streamlined system.